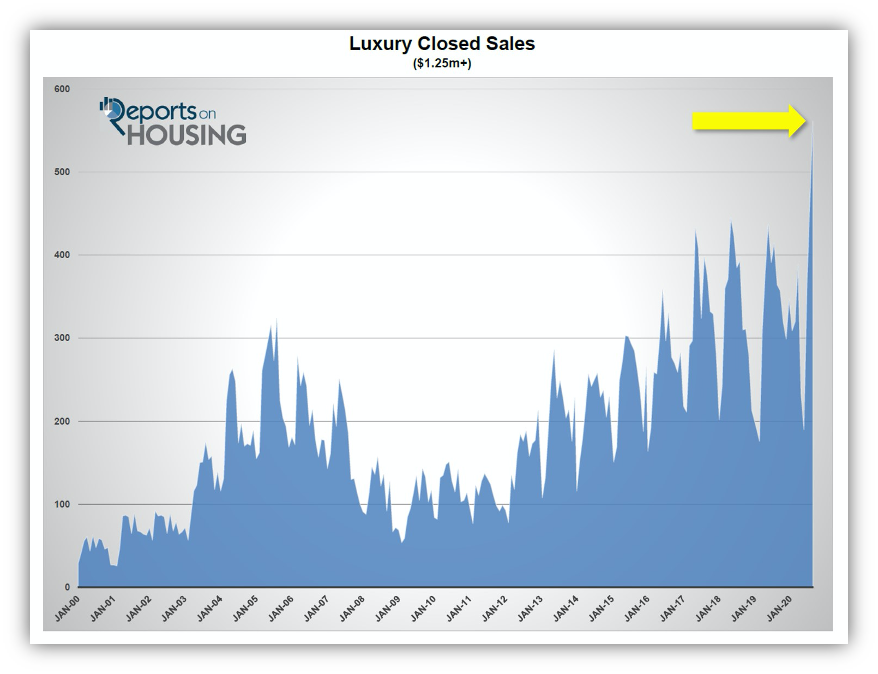

The luxury housing market not only bounced back from the initial shock of the Coronavirus, it has reached unprecedented levels. A record number of luxury homes closed in Orange County in August.

After a hiatus due to the Coronavirus, professional baseball, basketball, and hockey returned to empty stadiums and arenas. For sports enthusiasts, it was a welcome distraction to COVID-19 and the daily news. Hockey is in the midst of the Stanley Cup playoffs and down to the conference finals. The high intensity play is reminiscent of the Winter Olympics where hockey players around the world compete for gold. One of the greatest moments in hockey history occurred during the 1980 games, the “Miracle on Ice,” when the United States defeated Russia by scoring two goals in the final period. Despite Russia being heavy favorites, stacked with experienced, professional players, and winning five of the previous six Olympics, they lost to the United States whose roster was filled with amateurs and was the youngest of the 12 competing teams. The game was memorable and completely unexpected.

Life is full of unexpected events. Just like the “Miracle on Ice,” this year’s housing market has surpassed just about everybody’s expectations. Demand has been off the charts, the highest in years. The active listing inventory has remained at unbelievably low levels for this time of the year. Multiple offers are the norm. Home values are on the rise. Homes are quite literally flying off the shelves. Luxury housing has also beat everybody’s expectations and has been surging at a record pace.

In Orange County, luxury closed sales in August, homes above $1.25 million, hit a record high of 561. The prior high occurred in July at 464 sales. Luxury closed sales has only topped 400 in May and June of 2017 as well as May and June of 2018. August’s 561 closed sales was 21% higher than July, and 54% higher than August 2019’s 364 sales.

For all price ranges in Orange County, closed sales in August were up by 12% over last year, 3,153 closed sales in 2020 compared to 2,824 in 2019. It is the highest level since June 2017. A deeper look reveals that the higher ranges are performing stronger than the entry level. For homes priced below $750,000, year over year there were 189 fewer closed sales, 12% less. For homes priced between $750,000 and $1.25 million, there were 321 additional closed sales compared to last year, 37% higher. And for the luxury range, over $1.25 million, year over year there were 197 additional closed sales, an unbelievable 54% more.

For all price ranges in Orange County, closed sales in August were up by 12% over last year, 3,153 closed sales in 2020 compared to 2,824 in 2019. It is the highest level since June 2017. A deeper look reveals that the higher ranges are performing stronger than the entry level. For homes priced below $750,000, year over year there were 189 fewer closed sales, 12% less. For homes priced between $750,000 and $1.25 million, there were 321 additional closed sales compared to last year, 37% higher. And for the luxury range, over $1.25 million, year over year there were 197 additional closed sales, an unbelievable 54% more.

Quite simply, there are more closed sales in the luxury range than ever before. The high end is firing on all cylinders and it is most likely a combination of Wall Street’s return to record high levels, private banking relationships, and record low interest rates. It does not appear to be slowing, either. In looking at demand (the last 30-days of pending sales), there are 812 more pending sales than last year at this time, 32% extra. Luxury demand is up by an incredible 74%.

Not only is luxury outperforming any other time in terms of closed sales, it appears as if that trend will continue given the current velocity of demand. The Expected Market Time (the amount of time between hammering in the FOR-SALE sign to opening escrow) for homes priced between $1.25 million and $2 million is less than 60-days, a Hot Seller’s Market, a super-sonic pace for this price range. It is at 97 days for homes priced between $2 million and $4 million. For homes priced above $4 million, the Expected Market Time is 222 days. Yes, that is a lot slower than all other price ranges; however, it is far better than last year’s level at 527 days.

A warning to luxury sellers: luxury may be hotter than ever, but it still is not as hot as the lower price ranges. Homes below $1 million are experiencing the hottest activity with a mass number of showings, multiple offers, and very quick sales; however, it takes a bit longer to find success in the upper ranges with not as many showings and fewer multiple offer situations. Expecting instantaneous purchase offers is just not realistic.

OC MARKET SUMMARY

- The active listing inventory decreased by 68 homes in the past two-weeks, down 2%, and now totals 4,252, its lowest level for August since tracking began in 2004. COVID-19 is not suppressing the inventory and in August, there were 11% more homes that came on the market compared to last year. Last year, there were 6,997 homes on the market, 2,745 additional homes, or 65% more.

- Demand, the number of pending sales over the prior month, increased by 17 pending sales in the past two-weeks, up 0.5%, and now totals 3,340, its highest level since August 2012. COVID-19 currently has no effect on demand. Last year, there were 2,528 pending sales, 24% fewer than today.

- The Expected Market Time for all of Orange County decreased from 39 days to 38, a Hot Seller’s Market (less than 60 days). It was at 83 days last year, much slower than today.

- For homes priced below $750,000, the market is a hot Seller’s Market (less than 60 days) with an expected market time of 27 days. This range represents 34% of the active inventory and 47% of demand.

- For homes priced between $750,000 and $1 million, the expected market time is 28 days, a hot Seller’s Market. This range represents 18% of the active inventory and 25% of demand.

- For homes priced between $1 million to $1.25 million, the expected market time is 39 days, a hot Seller’s Market.

- For luxury homes priced between $1.25 million and $1.5 million, in the past two weeks, the Expected Market Time decreased from 52 to 49 days. For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 62 to 58 days. For luxury homes priced between $2 million and $4 million, the Expected Market Time decreased from 107 to 97 days. For luxury homes priced above $4 million, the Expected Market Time increased from 193 to 222 days.

- The luxury end, all homes above $1.25 million, accounts for 39% of the inventory and only 18% of demand.

- Distressed homes, both short sales and foreclosures combined, made up only 0.3% of all listings and 0.4% of demand. There are only 5 foreclosures and 8 short sales available to purchase today in all of Orange County, 13 total distressed homes on the active market, down 2 from two-weeks ago. Last year there were 50 total distressed homes on the market, more than today.

- There were 3,010 closed residential resales in July, 5% more than July 2019’s 2,871 closed sales. June marked a 39% increase compared to June 2020. The sales to list price ratio was 98.0% for all of Orange County. Foreclosures accounted for just 0.3% of all closed sales, and short sales accounted for 0.2%. That means that 99.5% of all sales were good ol’ fashioned sellers with equity.